5 Ways To Make Sure Your Data Is Protected

Unfortunately, data theft is a very real concern that can have severe consequences, including financial losses and challenges in securing loans, credit cards, or mortgages.

Many of us are not aware of the dangers involved in overlooking the security of our personal information.

CCDL has crafted a quick guide below to ensure you remember the essential steps in safeguarding your sensitive information

1. Secure Confidential Waste Collection:

Identity protection begins with the responsible disposal of confidential waste. Engaging professional services for confidential waste collection ensures the secure handling and destruction of sensitive documents. From old bank statements to utility bills, these documents carry information that can be exploited by identity thieves.

2. Complete Destruction of Old Bank Cards:

Financial institutions issue new bank cards periodically, and it’s essential to dispose of the old ones securely. Destruction is key – cut through the numbers, chips, and any identifying features to render the card unusable. This simple yet effective measure prevents unauthorised individuals from accessing your financial information and protects you from potential identity theft.

3. Secure Disposal of Electronics:

With technology evolving rapidly, it’s common to upgrade laptops and smartphones. However, the information stored on these devices can be a goldmine for identity thieves. Ensure you have laptops and old phones professionally wiped or destroyed when they are no longer in use for professional purposes. This prevents unauthorised access to personal data, including emails, contacts, and other sensitive information that could be exploited.

Tip: make sure you use a WEEE approved waste company for your electronic waste to avoid it ending up in the wrong place.

4. Mindful Handling of Post:

It might seem like a basic precaution, but how you handle your post can impact your vulnerability to identity theft. Avoid leaving post with your address on display, especially in shared spaces or areas accessible to the public. Identity thieves can use this information to piece together details about you, making it easier to commit fraud or other crimes.

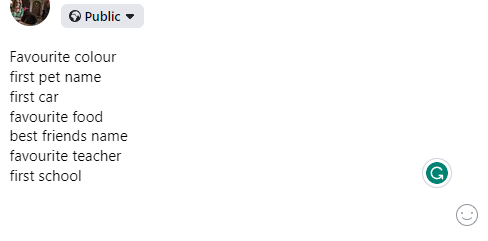

5. Be Careful Online

Be cautious about what you share online – avoid falling into the trap of viral posts requesting personal information like your first car or pet’s name. This seemingly innocent data is often used as password reminders. By participating in these questionnaires, you may unwittingly expose a significant part of your passwords.

Signs of Data / Identity Theft to Watch Out For:

- Loss or Theft of Important Documents:

If you lose important documents such as your passport or driving license, you become vulnerable to identity theft. Report any lost or stolen documents promptly to the issuing authorities to minimize the risk. - Non-receipt of Mail from Financial Institutions:

Missing mail from your bank or utility provider could indicate that someone has redirected your mail or gained unauthorized access to your accounts. Investigate any disruptions in your mail delivery promptly. - Unrecognised Items on Bank or Credit Card Statements:

Regularly review your bank and credit card statements for any transactions you don’t recognize. Identity thieves often make small, inconspicuous transactions to test if they can go unnoticed. - Unexpected Bills or Receipts:

If you start receiving bills or receipts for goods or services you haven’t requested or received, it could be a sign that someone is using your identity to make unauthorized purchases. - Refusal of Financial Services Despite a Good Credit Rating:

Identity theft can impact your creditworthiness. If you’re refused financial services despite having a good credit rating, it’s crucial to investigate the reason behind the denial. - Letters from Solicitors or Debt Collectors for Debts You Don’t Owe:

If you receive letters regarding debts that you are not aware of, it could be a red flag for identity theft. Investigate and report such instances promptly.

How to Reduce the Risk of Identity Theft:

- Store Documents Securely:

Documents carrying personal information, such as your driving license, passport, bank statements, utility bills, or credit card receipts, should be stored in a safe and secure place at home. - Shred Old Documents:

Shred or have a confidential waste company destroy old documents to ensure that nothing with your name, address, or other personal details can be taken by identity thieves. This simple practice is an effective way to prevent information exposure. - Monitor Credit Reports:

Regularly monitor your credit report to check for any suspicious credit applications. Many credit reporting agencies provide free access to your credit report, allowing you to stay informed about any changes. - Update Address Information:

When you move house, promptly update your address with relevant service providers, including your bank, credit card companies, mobile phone providers, utility providers, and others. This prevents sensitive information from falling into the wrong hands. - Be Cautious Online:

In the digital age, online security is crucial. When buying online, use secure websites that display the company’s contact details. Look for a golden padlock symbol and ensure a clear privacy and returns policy. Check that the web address begins with “https” for added security.

What to Do If You’re a Victim of Identity Theft:

If you suspect or confirm that you are a victim of identity theft, taking swift action is crucial to mitigate potential financial losses. Follow these steps:

- Report Lost or Stolen Documents:

Immediately report any lost or stolen documents, such as passports, driving licenses, credit cards, and chequebooks, to the organizations that issued them. - Inform Financial Institutions:

Notify your bank, building society, and credit card company of any unusual transactions on your statement. They can help investigate and take the necessary steps to secure your accounts. - Request a Copy of Your Credit File:

Obtain a copy of your credit file to check for any suspicious credit applications. Early detection allows you to take corrective measures and prevent further damage. - Report to the Police:

Report the theft of personal documents and any suspicious credit applications to the police. Obtain a crime reference number, which can be valuable when dealing with other authorities. - Contact CIFAS for Protective Registration:

Consider applying for protective registration with CIFAS, the UK’s Fraud Prevention Service. Once registered, CIFAS members will conduct extra checks when anyone applies for a financial service using your address.

Your identity is a valuable asset, and protecting it requires a proactive and comprehensive approach. By following these tips and strategies, you can significantly reduce the risk of identity theft and its potential consequences.

Secure Your Identity, Choose CCDL’s Confidential Waste Collection Services Today! Protect your sensitive information with our professional and reliable waste disposal. Don’t risk identity theft – take control now. Click to schedule your confidential waste collection and enjoy peace of mind.

You might also like:

Enjoyed this article? Check out the rest of our recycling blogs and follow us on facebook for all of our latest news